Today I want to do a deep-dive into Convex Finance, which I refer to as my DeFi Cashflowing 401k. Over the last few months, I’ve made over $8k through voting (and possibly even more in 2 weeks).

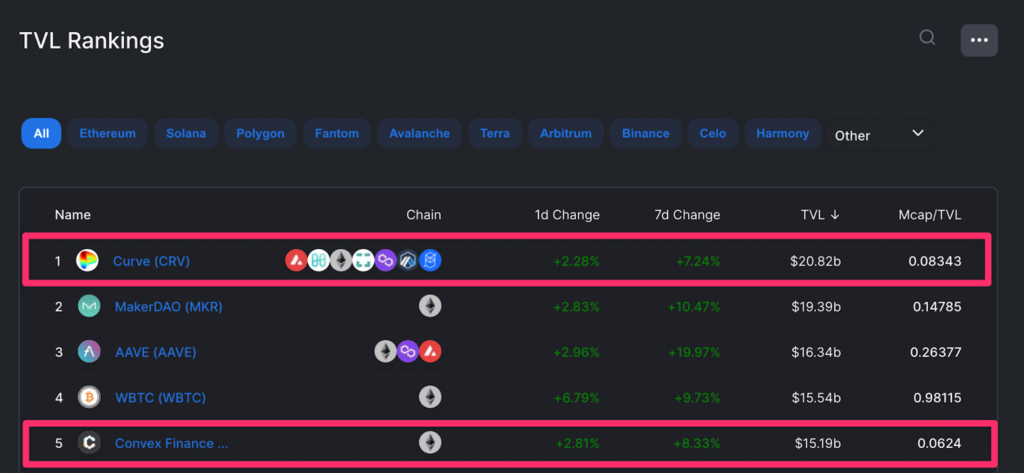

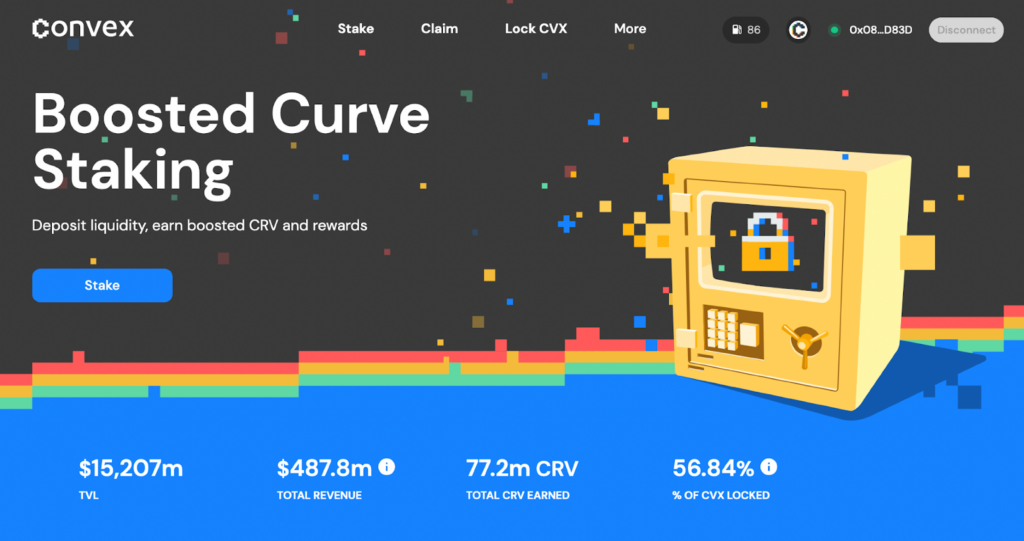

Convex is only 7 months old and has over 14 Billion in total value locked (TVL). It controls the majority of Curve (aka the backbone of DeFi) which has over 19 Billion of value… so this one protocol controls over 32 Billion.

But what is it? Convex was created to help Curve liquidity providers to maximize their yield returns. Before I jump into what Convex does, let’s first understand why Curve is so important.

Disclaimer: I own $CVX and $CRV but I’m not giving you financial advice. I’m just a friendly stranger on the internet sharing some cool DeFi projects. If you’re brand new to DeFi, check out my article: Introduction to Decentralized Finance.

Automated Market Maker (AMM)

When creating a robust decentralized financial ecosystem on the blockchain there are a few key components that need to exist for it to work.

One of them is decentralized exchanges that allow trading to happen through their automated market makers (AMM). It’s like Coinbase or Robinhood, except it’s decentralized and runs entirely on smart contracts that interact directly with your wallet.

Automated Market Maker is just another way of saying, that traders can make trades using pools of money instead of having to connect a buyer and a seller. This is all done through smart contacts which allow investors to lend out their crypto into these pools and become liquidity providers.

For every transaction made within the pool they’re invested in, they receive a percentage of the fees made for the trade.

Think of it like a currency exchange kiosk at an airport, except this time as a crypto investor you are the kiosk and you receive a small fee for providing liquidity.

Curve 101

Curve Finance is one such exchange that offers low-slippage stable asset trading through their Automated Market Maker setup. Curve specializes in exchanging stablecoins (USDC, DAI, UST, etc) or coins of equivalent value like renBTC, wBTC, etc with almost no slippage..

What is slippage?

Let me explain slippage in the view of stock trading, let’s use Facebook as an example (AKA Meta Platforms Inc ).

The price of Facebook is $329.68. That means you can buy some shares at the price of $329.68 but that does not mean that you can buy a lot of shares for $329.68. That’s because there may not necessarily be many shares available at the price of $329.68.

Once you purchase all the shares available for that $329.68 price, you would need to spend more to get more and your order would go run through the order book. Slippage is the difference between the expected and executed price on a trade.

When liquidity in a market is low there will be a high slippage rate because in an illiquid market, things are harder to buy and sell quickly.

The curve has deep liquidity pools, which allows it to have low slippage. You can see below that it has over $20.8 Billion in deposits!

Given that, for DeFi to be able to work there needs to be liquidity in the market.

The curve is providing this liquidity and hence is crucial to the ecosystem.

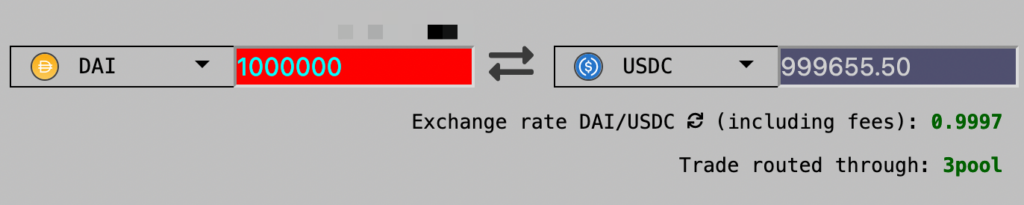

Here’s an example of what a million-dollar stablecoin swap looks like on Curve:

There’s an exchange fee of $345 to make that swap… not bad at all.

If you are providing your stablecoins for liquidity inside of that pool you would receive a percentage of this fee for providing the service.

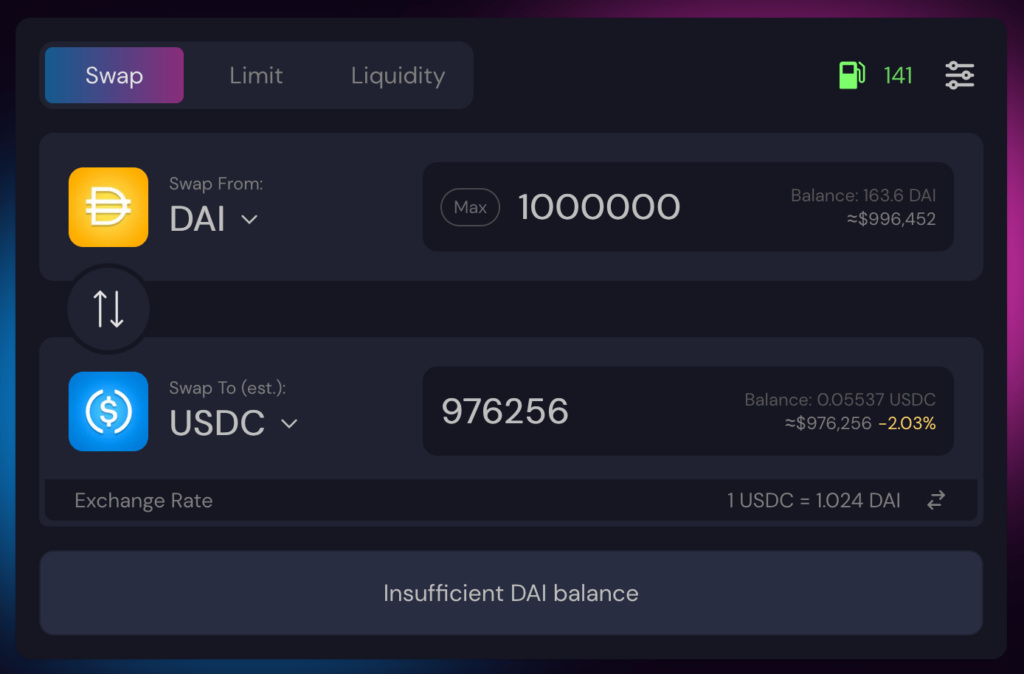

Alternatively, on Sushi you’d lose 2.03% to slippage and would only get $976,256 — a $23,744 difference!

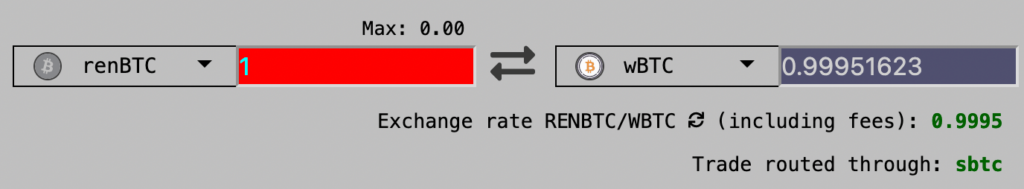

The curve also deals with exchanges of equivalent value coins like synthetic Bitcoin (renBTC or wBTC) as seen here:

CRV Tokenomics

When providing liquidity into a pool, you are rewarded with the CRV token. This is a governance token that encourages participation in the community.

In DeFi, governance tokens are the accepted method of decentralization. They distribute tokens to users and each is worth one vote when a decision is made in governance.

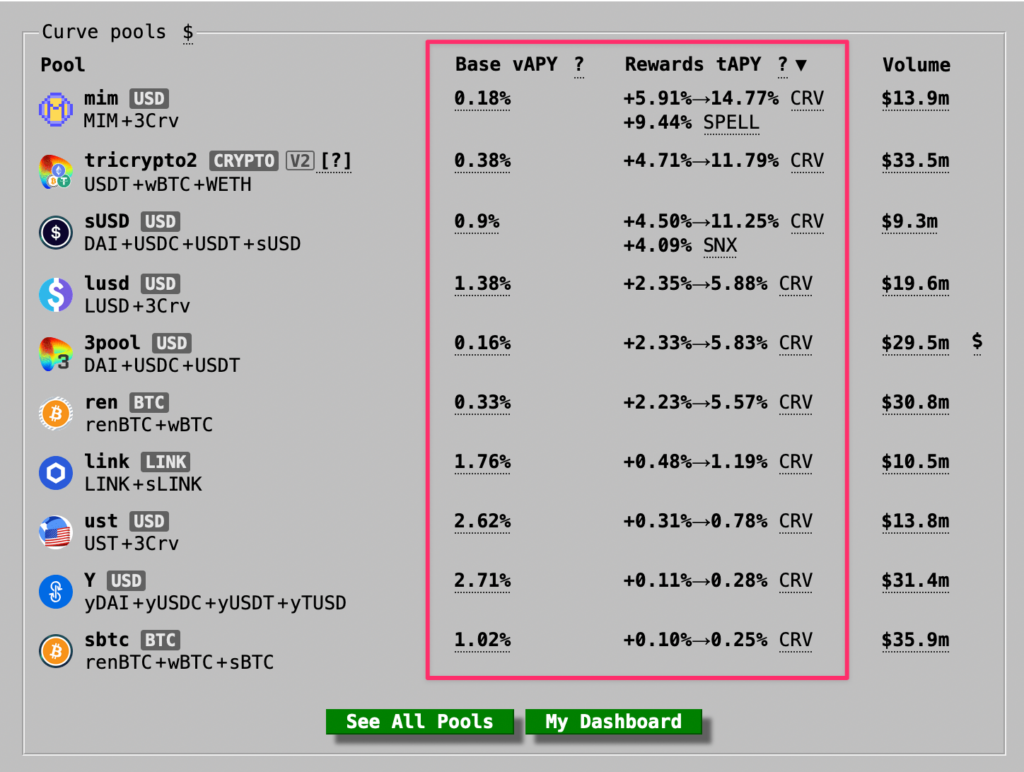

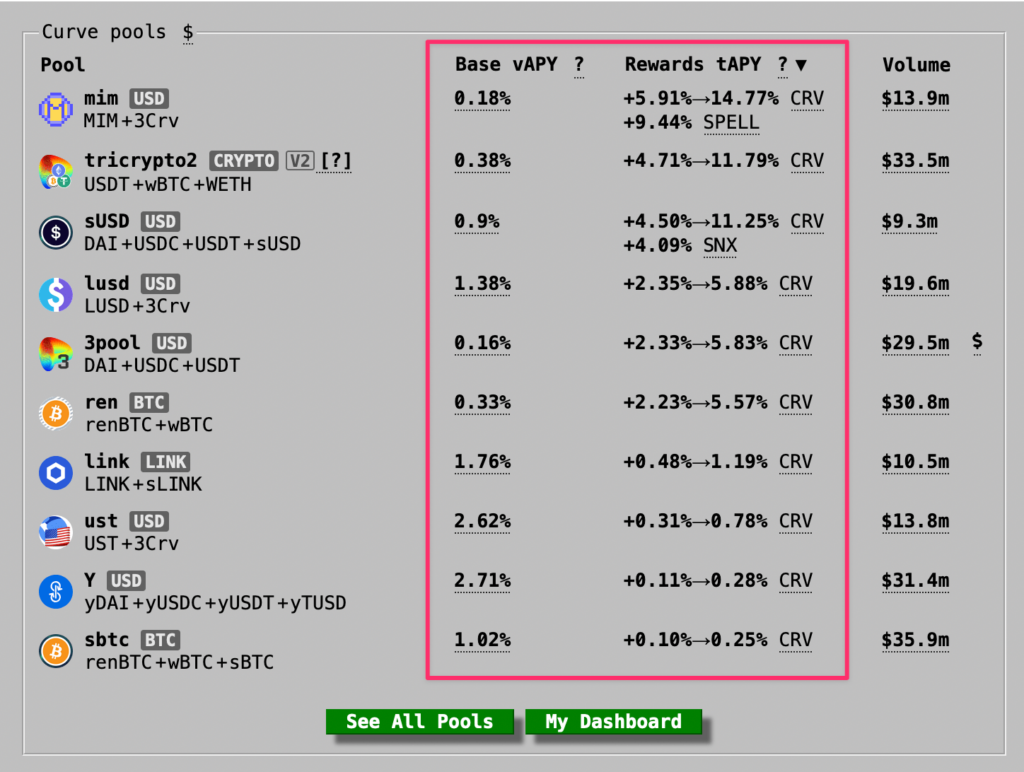

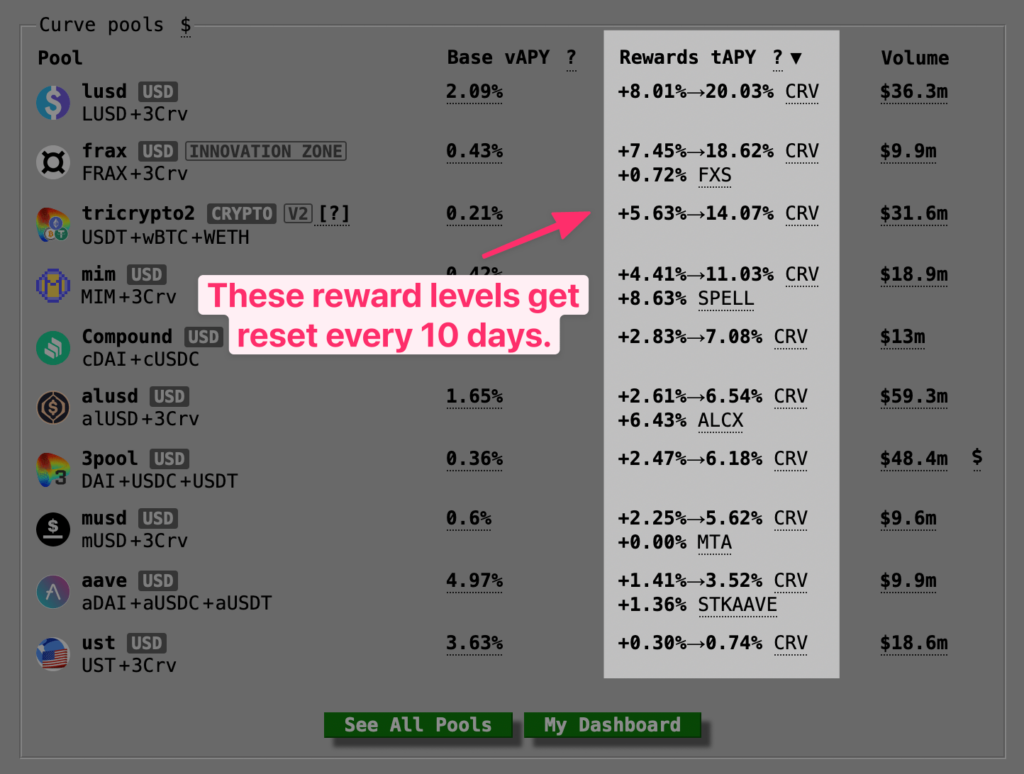

Here’s what yields are looking like across different pools:

The top reward pool is MIM (Magical Internet Money… yes really) a stablecoin pegged to $1 is getting up to 14.77% in CRV and an additional 9.44% in $SPELL token. That’s a 24.21% APR!

(Curious why they are getting the most rewards? I’ll get to it…)

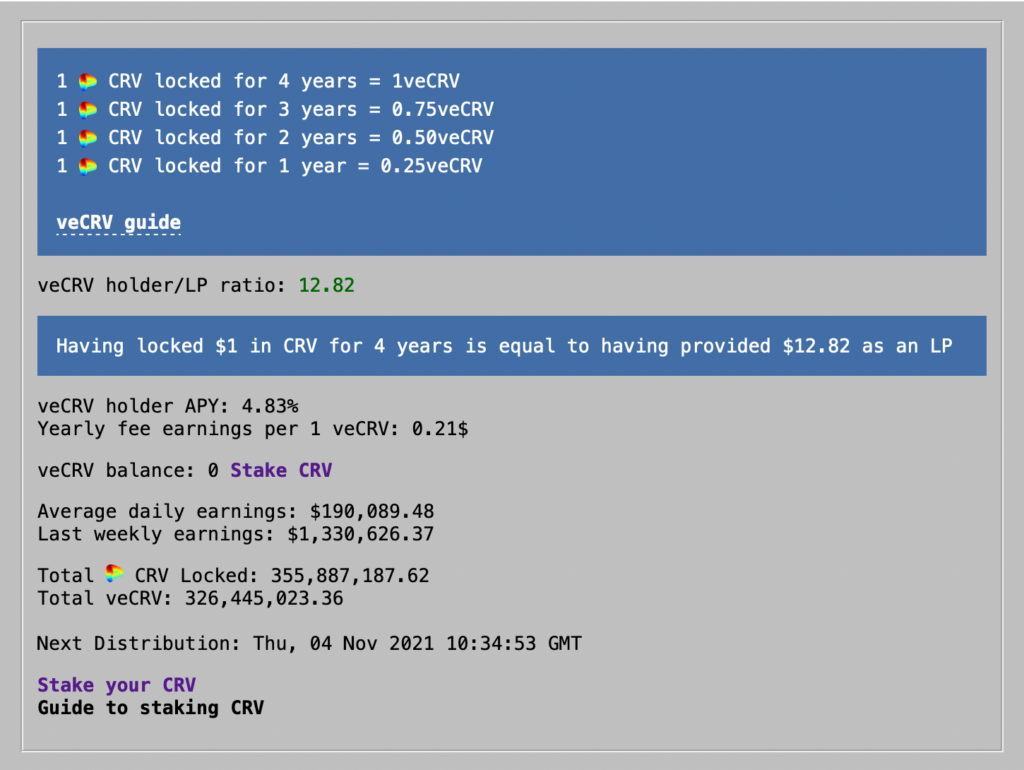

Now what’s different about Curve governance tokens is that they only share revenue and voting power with those who lock their CRV. This then converts their CRV for vote-escrowed CRV (veCRV).

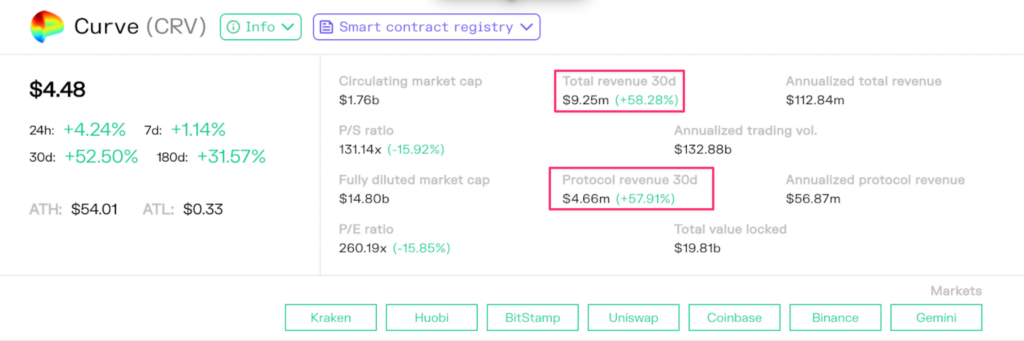

FYI, Curve made $4.7m in revenue over the last 30 days according to Token Terminal.

This means for a cut of this $4.7m monthly revenue, boosts and voting you need to lock your tokens away. Depending on the amount of CRV locked and the length of time chosen, stakers are given an adjusted amount of vote-escrowed Curve (veCRV) as seen below:

Once staked, veCRV holders are entitled to:

- Voting rights in the Curve DAO

- 50% of the trading fees on Curve

- Up to 2.5x boosted CRV rewards for own LPs

Why are voting rights so important that you would lock your liquidity?

Well, veCRV holders vote on how CRV rewards are distributed across Curve’s pools. Typically as a voter, you would align your financial interests with how you assign your vote to the gauge.

The gauge is a way to measure which pool is weighted most heavily with rewards and gauge votes occur biweekly via Snapshot. So in the above example, MIM received the highest rewards due to the bi-weekly gauge vote. If you’re bullish on the $SPELL protocol (I am) then you would want the MIM pools to have the strongest yields.

In the above example, the only wallets getting 14.77% of CRV for the MIM pool are the people who lock their CRV for 4 years.

But who really wants to lock their coins away for 4 years for maximum boost?

(4 years is a lifetime in crypto… in fact many lifetimes.)

Enter Convex Finance

Convex was created to help Curve liquidity providers get the highest ROI on their funds. It doesn’t change anything that Curve does as far as automated market making, its only job is to maximize collection of CRV as well as provide alternative yields.

If you’ve ever been to the Curve website and tried to use it you’ll understand their UI sucks and is not very intuitive. It’s like a time machine back to the early web days… so while Curve is a great way to earn yield, it’s complicated AF and overwhelming to use.

(I say this as someone who avoided it until Convex came along)

Convex finance is the younger and more easy-to-use sibling that allows investors to get lucrative returns without locking up liquidity. There are

There are staking rewards, liquidity rewards, and other fun things like airdrops (which is magical money that you get just using DeFi tools, but more on that another time)

For earning on stables you can stake your stablecoins in Curve, then take your liquidity pool tokens and stake them in Convex Finance for boosted rewards. It’s like you’re boosting your rewards through locking, without needing to lock for 4 years!

Staking rewards

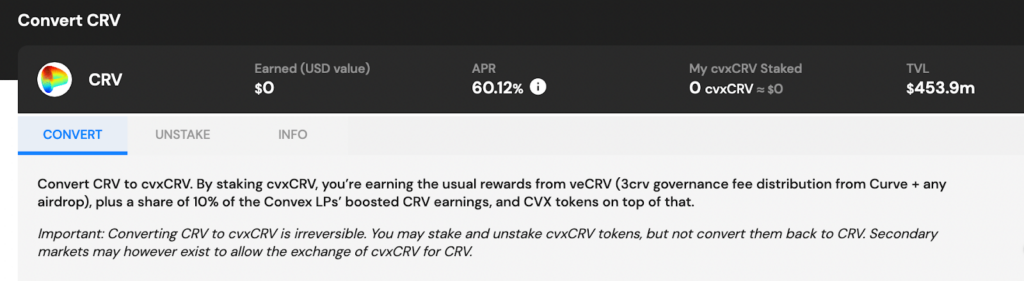

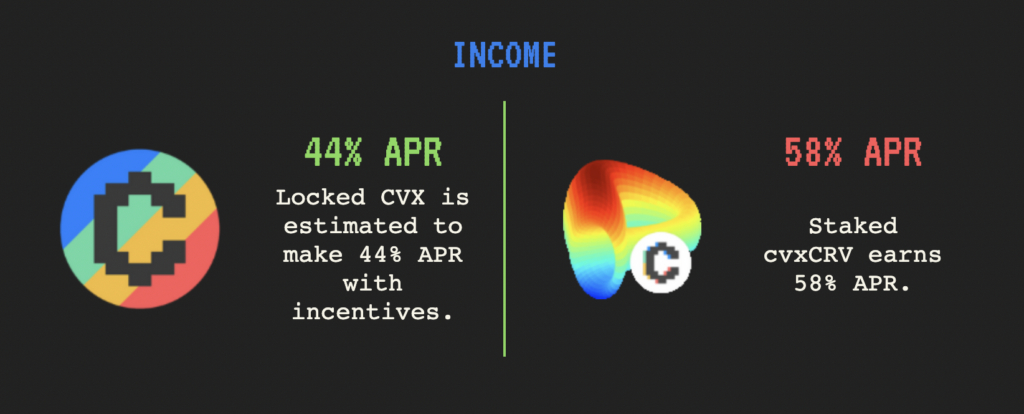

Convex rewards CRV stakers with a share of the boosted CRV on Convex. This allows you to make higher returns while remaining liquid (not needing to lock up for 4 years).

- Earn a share of the Convex platform fees

- Claim airdrops such as EPS (a stablecoin swap on Binance Smart Chain)

- Earn trading fees from the Curve platform (in the form of 3CRV)

- Receive CVX rewards

- Receive cvxCRV which will allow you to exit your staked CRV position

Liquidity provider rewards

Like staking rewards, liquidity providers can also earn revenue and claim boosted CRV without locking up their CRV. This allows for both liquidity and maximum rewards.

- Earn claimable CRV with a high boost without locking any CRV

- Earn CVX rewards

- Zero deposit and withdrawal fees

- Zero fees on extra incentive tokens

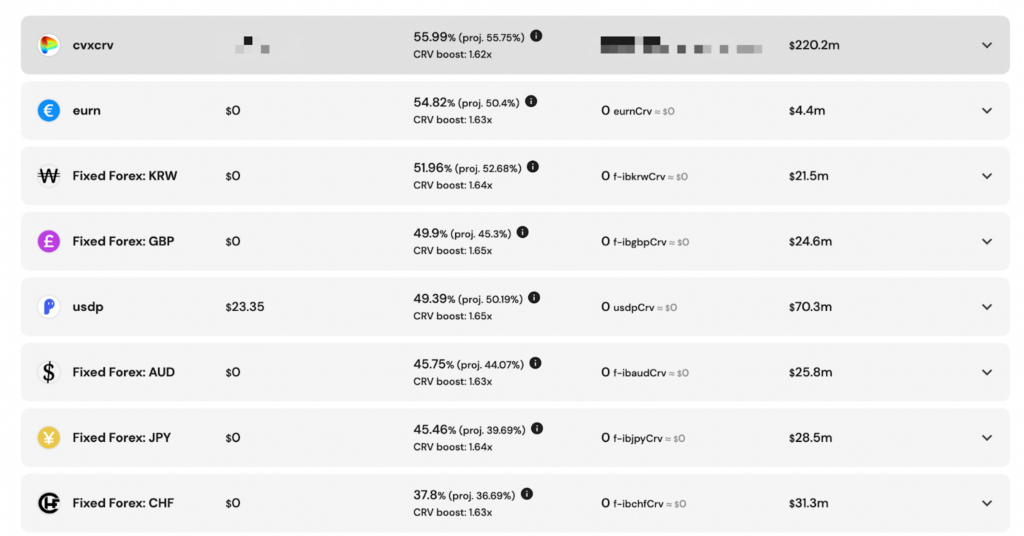

Here are some examples of boosted liquidity pools (you see Fixed Forex GBP, a synthetic stablecoin pegged to the British pound is getting nearly 50% APR):

If you want to get the highest yield possible, rather than a stake in CRV gauge you can take your LP tokens and put them into Convex Finance and make 36.6%, a 1.62x boost.

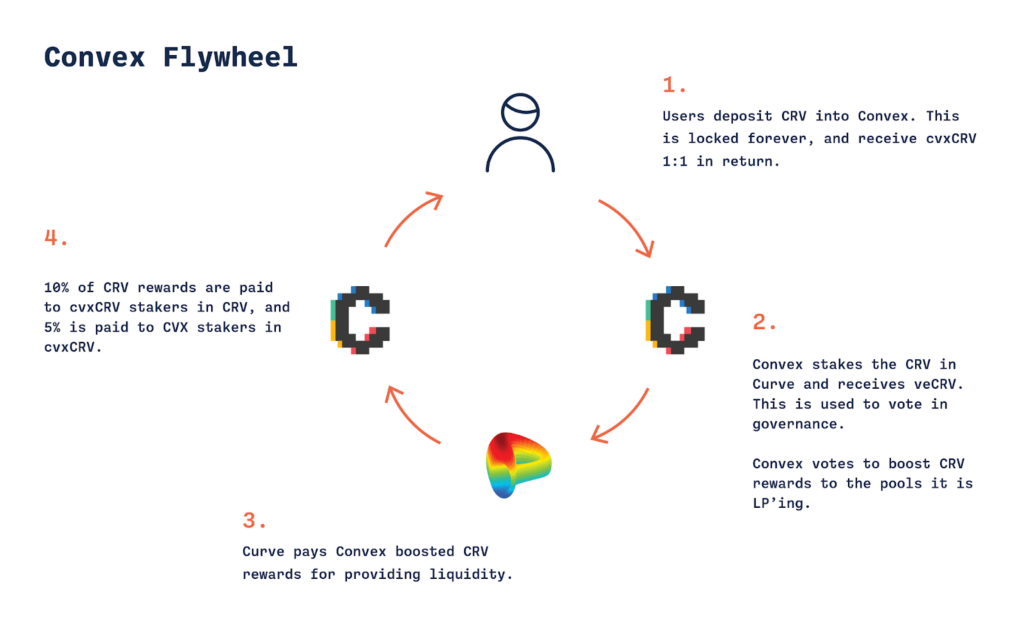

cvxCRV Token

A tokenized version of vote-escrowed CRV (veCRV) is cvxCRV.

When you deposit CRV on Convex you will get cvxCRV tokens back. This action is permanent. Essentially Convex is doing the job of locking your CRV tokens for maximum boost and giving you back a synthetic version of the token in cvxCRV whose price runs close to that of regular CRV.

Once users deposit CRV on Convex in exchange for cvxCRV tokens, the action is irreversible, meaning that the CRV tokens will be locked forever.

The Flywheel

Liquidity is key for success in DeFi which is why protocols fight for the free money in the form of CRV tokens for their token’s pools.

The rewards of CRV pools get reset every 10 days and staked CRV holders vote on who gets what for the next round. The pools that are voted to get the most CRV rewards mean the strongest yields for those projects.

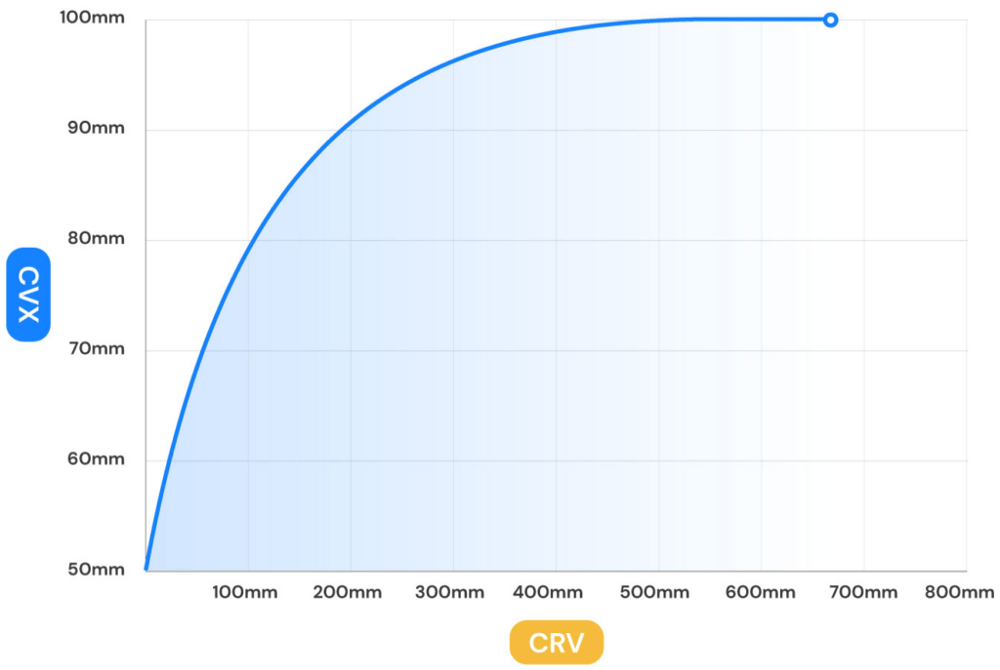

Total supply cap: 100 million CVX

Emission schedule: The ratio of CVX to CRV emitted is reduced after every 100,000 CVX minted.

Convex now owns over 50% of the Curve governance, however, they have their own voting system through which the Curve proposals get passed through.

Due to this, Convex decides the emission schedule for 18m worth of CRV rewards and 30m worth of CVX every 2 weeks (through voting) — so projects are fighting for their share of the pie.

What this means is if you hold the $CVX token your voting power in Curve grows, but if you use CRV directly (by locking as veCRV) its power decays over time. Why?

CVX grows in power the more CRV that gets locked up in its smart contracts whereas veCRV decreases in power thru dilution.

Now as if Convex wasn’t interesting enough, enter bribes… a method of earning passive income on your CVX tokens.

credit: Llama Airforce

Passive income thru bribes

If we consider Convex Finance as a union that controls CRV rewards, then as a project it’s in our interest to get the union to vote in the favor of our project.

And how do we do that? Align incentives!

For protocols to receive the best and highest rewards for their project, incentives must be paid to the union.

(Ah yes, crypto and the real world are not so different after all.)

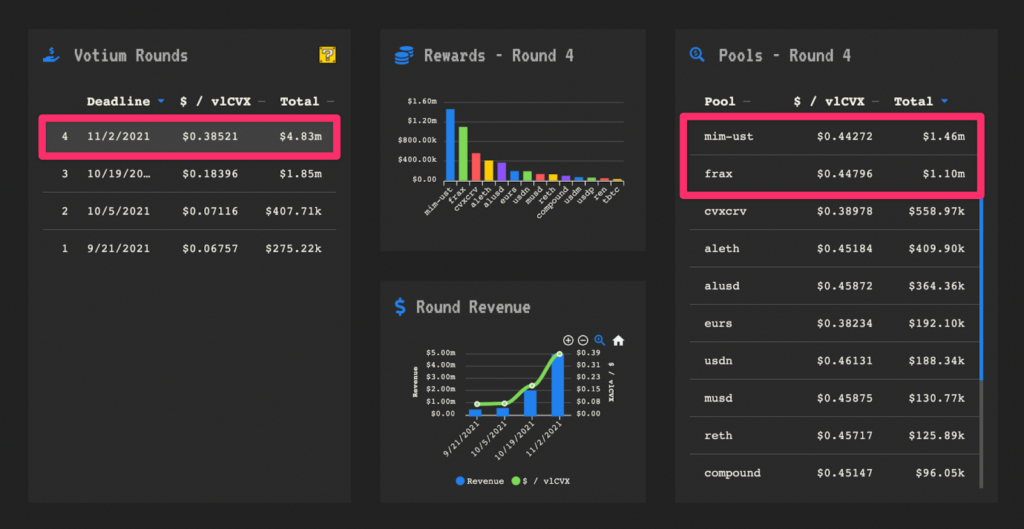

To become eligible for these incentives, you need to become part of the union by locking your CVX for 16 weeks. Once locked you can vote on what pools within Curve will receive the most rewards. The approximate income on your locked CVX is around 44% as of round 4 — so this is the income on rewards, not accounting for the token value increase.

How voting (bribes) work:

Let’s take $FXS, the protocol behind the stablecoin Frax. They want the highest rewards for their pool and so they incentivize locked CVX holders to vote for them through incentivizing with tokens.

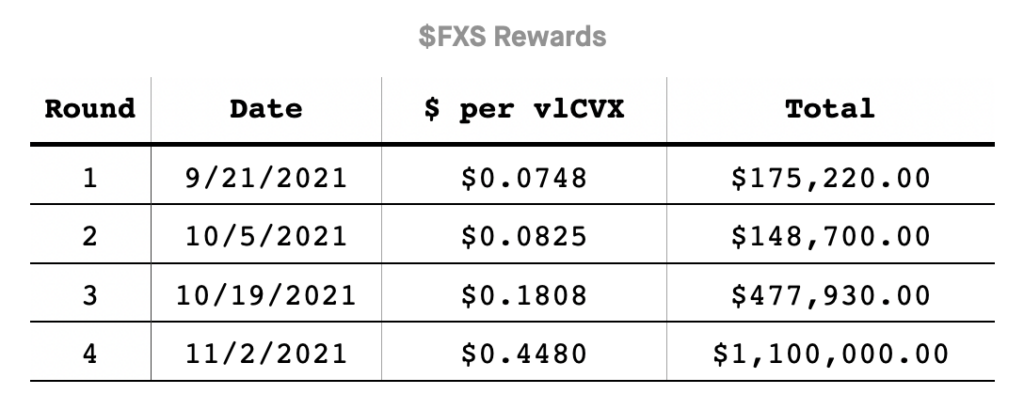

There have been 4 voting rounds so far & Frax has participated in all of them. They have increased their vote rewards each round from 175.22k in round 1 (0.0758 per locked CVX) to $1.1m ($0.4480 per locked CVX) in round 4.

So if you voted for Frax to receive your votes in the 11/2/2021 round you would have received $0.4480 per locked CVX. At the current price of $28.13 per CVX, that’s a 1.56% dividend every 2 weeks.

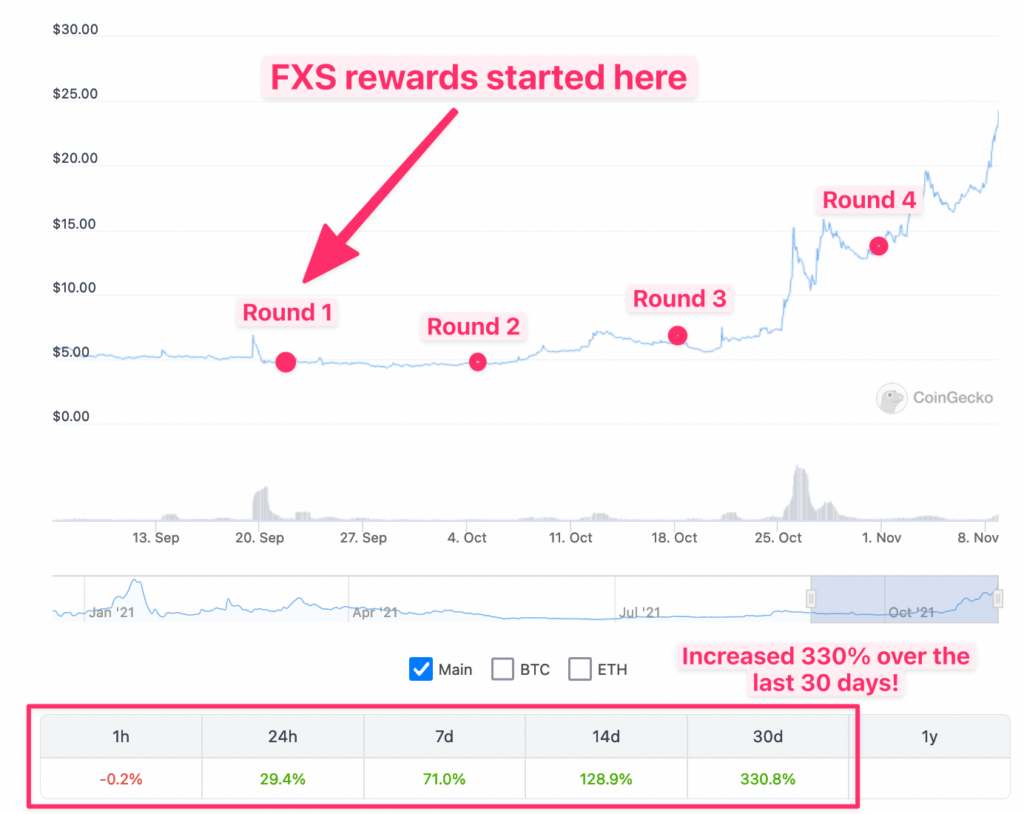

If you’d claimed the FXS and held you would have seen a 3.3X increase in price tokens due to appreciation. See the FXS chart below:

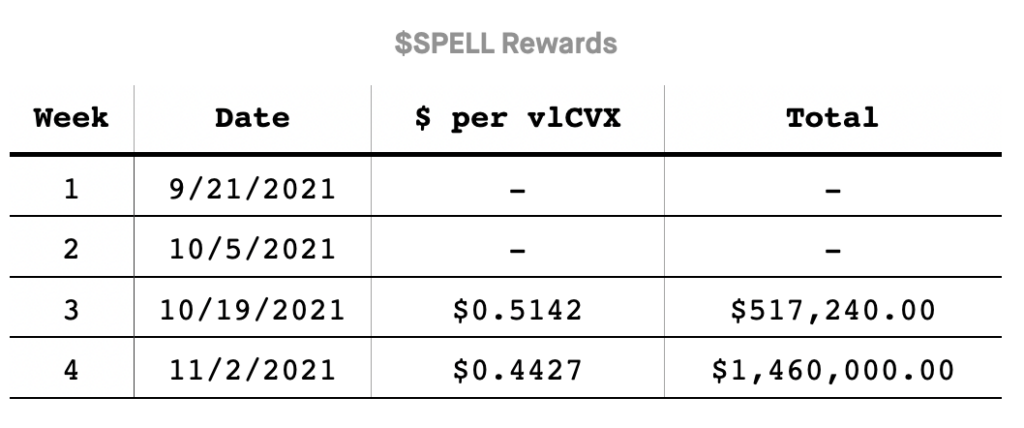

Another project that’s aping in to incentivize votes is Spell (Abracadabra.money), the project behind the MIM token. Over the last 2 rounds of voting, they’ve given almost $2 million in rewards!

What’s even crazier is the $Spell token has been on a crazy run. So the tokens received on the 10/19/2021 round have doubled in price, which means a double yield for you if you held.

🥳 Claim are now up on https://t.co/e83ONbsc2U !

— Votium (@VotiumProtocol) November 3, 2021

🔥 ~$5m in rewards deposited for $CVX lockers for their vote this round!

💰 Votium delegators got ~$0.44 per vlCVX!

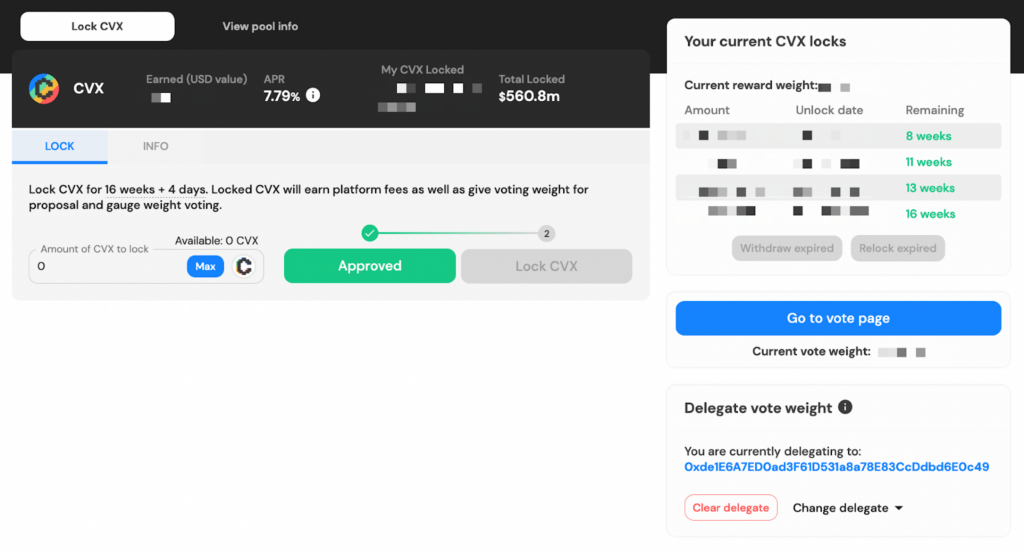

To be able to partake in the bribes, you will need to lock your $CVX for 16 weeks and delegate to Votium (0xde1E6A7ED0ad3F61D531a8a78E83CcDdbd6E0c49). Once you lock you will have a lock date and a time remaining date.

As you can see below I have done different locks over the last few months and after getting over 8k in bribes overall I’ve decided to go all in and lock my CVX.

(It’s a great way to ensure I don’t paper-hand it which I’ve been known to do)

You can see what that looks like here:

From there they can delegate your vote, or if you want specific project coins you can concentrate your vote on certain projects. So for example I have focused my last vote 50/50 between Frax & Spell given they were offering the highest reward levels.

Llama Airforce is a great site to keep track of bribe amounts and rewards.

Given the high cost of gas, I didn’t want a bunch of random coins that I’d need to claim. I’d prefer more of a few select tokens I believe.

(P.S. The $SPELL tokens can be staked for an additional 23% APR for more free money!)

Bribes

Convex decides the emission schedule for 18m worth of CRV and 30m worth of CVX every 2 weeks. So the chances of the bribes increasing even more over the following rounds is high as it’s an efficient use of tokens for the projects to gain.

Check this out:

How much 💰 should I bribe?

— CryptoCondom (@crypto_condom) November 7, 2021

➡️ For every $1 spent on bribes, your gauge would receive $4.24 in $CRV & $CVX rewards.

➡️ Bribes will be cheaper than directly incentivizing liquidity w/native token rewards until bribes >$1.92 / vlCVX. Assuming a price of $CRV & $CVX at $4 & $22

👇

300% ROI over 2 weeks? Well, that’s a crazy good business decision.

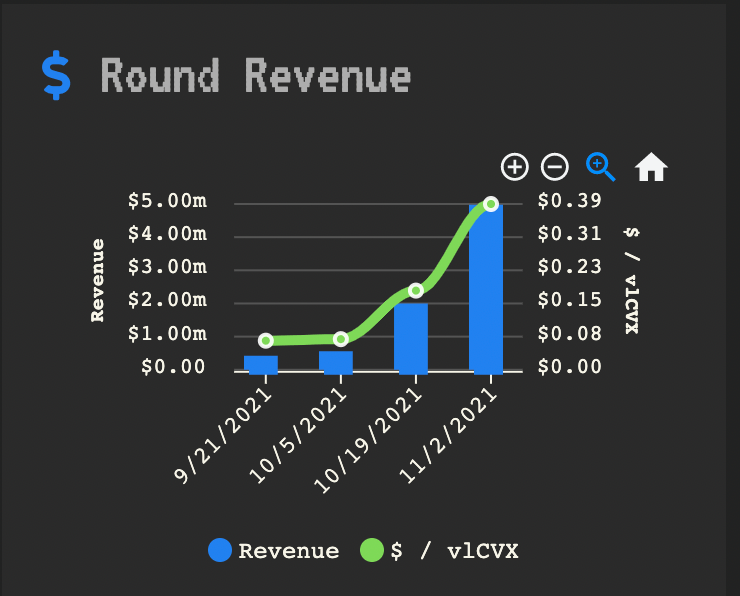

You can see how the revenue each round has been increasing below:

Round 4 had 4.8m of bribes given for $48 million of rewards. As projects catch on to this they will be fighting for their share of rewards as you are given their tokens as incentives.

The smartest condom I know says so:

In regards to $vlCVX and @VotiumProtocol, a question I see often is: "How much higher can bribes go?"

— CryptoCondom (@crypto_condom) November 3, 2021

The answer is: A LOT...5-10x 🤯

Convex decides the emission schedule for $18M $CRV and about $30M $CVX over each two week epoch.

Last epoch was $4.8M for $48M rewards 💰

👇 pic.twitter.com/55umVnTxOR

The next vote opens on Nov 11th so if you do want to get your bribes you’ll need to lock up your $CVX by then.

Bullish Signs

Now projects are starting to acquire $CVX for their treasuries as they are seeing the power.

Just this weekend the $ROOK project governance passed a vote to buy $40 million worth of $CVX at an average price of $40 per token. The current price of $CVX as I write this is $28.52, so they’re already pricing in a 40% increase they are willing to pay.

$ROOK proposal passed.

— 0xPabloCat (@0xcatdawg) November 7, 2021

This means they'll be spending up to $40M to acquire 1-2M worth of $CVX @ average price of $40.

Current price of $CVX: $28.91

Probably nothing. https://t.co/VN9yIrR8xW

Next up is the Olympus Dao project which is currently voting to add $CVX to its treasury as exposure to strategic assets.

An acquisition of Convex would help OlympusDAO gain significant exposure and governance power over the Curve ecosystem. Convex has built a moat with Curve by commoditizing Curve Boost and acquiring considerable control over the protocol versus auto-compounding by selling CRV.

$OHM RFC proposal to acquire 1% of $CVX in its treasury through bonds. Keep an 👀 on this.

— 0xChaos (@0xCha0s) November 8, 2021

➡️ influence $CRV flow of liquidity

➡️ CRV:CVX is 7 but will 🆙

➡️ Bribes are free 💰

➡️ Time sensitive 🔜 due to CVX emissions taperinghttps://t.co/SgC9NpQlqJ

No one has enough $CVX

How to Buy & Lock $CVX

If you’re interested in buying and locking Convex but aren’t sure how to get started. Here’s a quick video I recorded showing you how to buy it through dApps and lock it. From there you’ll be able to participate in all future bribes.

How to vote with your vlCVX to get the most $:

Conclusion

As long as Curve remains important in DeFi, then Convex will be important.

If Curve is the backbone of DeFi, and Convex controls Curve… then Convex is the most powerful protocol in the DeFi ecosystem and essentially controls the liquidity of stablecoins. With the US government now discussing regulations as stablecoins are more widely accepted, this is very bullish for the curve ecosystem as a whole.

$CVX is still not listed on any major exchanges, meaning the only people able to take advantage are those who are already comfortable in DeFi. We’re still early and as more and more CRVs get locked in the Convex smart contracts, the more valuable and powerful the project becomes.

Given Convex controls Curve (20 Billion TVL and growing) it’s a no-brainer. Even if everyone pulled their liquidity tokens and CRV out of Convex the CRV they have already locked will be extremely influential. Not to mention that you can make income through bribes as well as token appreciation.

Additionally, given the rise of stablecoins and the regulation being proposed in the space, that makes me bullish on Curve. On top of that with Curve V3 coming shortly which will allow for more volatile swaps it could get even bigger.

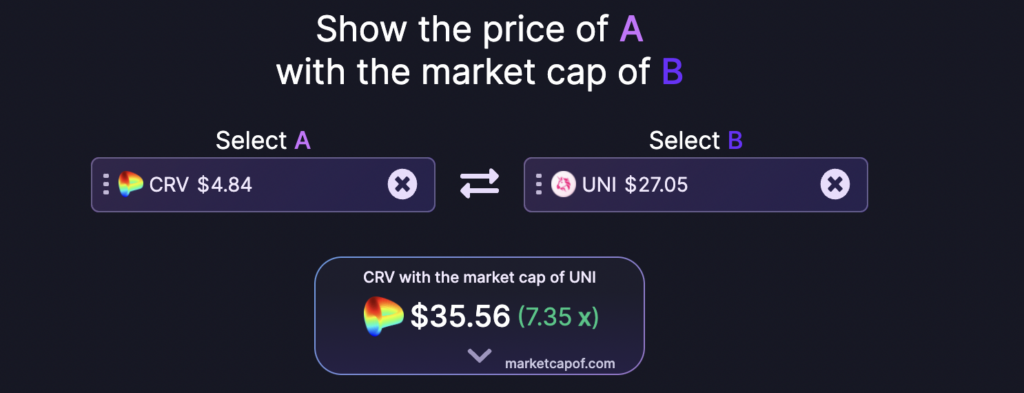

If Curve were able to compete and match the marketcap of Uniswap… well that would be swell. (Although they’d likely need to do a UI overhaul for that. )

$CVX Twitter Follows

If you want to stay up to date with $CVX (I’m here) and here’s some Twitter accounts I’d recommend you follow:

Curious about where DeFi gets its yield? Check out this video:

Want to get started in DeFi but aren’t sure where to start? Check out my course Zero to DeFi where I’ll walk you step-by-step through getting started.

Become a subscriber receive the latest updates in your inbox.